Sinnamon Park Financial Year Report 2018-2019

Hi and welcome to your financial year market overview, focusing on the beautiful suburb of Sinnamon Park in the 2018/2019 fiscal year.

It has undoubtedly been a challenging year for the property market with an array of varying reports throughout the mainstream media. These were some of the headlines:

The ABC on 19 March 2019:

Australia’s $133 billion property price slide rapidly becoming the worst in modern history

The Sydney Morning Herald on 19 March 2019:

House prices tumble even faster than during the GFC

The Courier Mail on 21 March 2019:

Why house prices could plummet even further

It was a concerning outlook, and these headlines were a sample of the ‘Doom and Gloom’ for over 12 months. However, it is incredible how quickly the sentiment can change, even over a period as short as three months:

A headline from the ABC on 17 July 2019:

Adelaide, Brisbane property prices set to rise by 2022… Brisbane is tipped to have a 20 per cent increase in the next three years.

The Sydney Morning Herald on 1 August 2019:

House prices stabilise as rate cuts start to help property market

The Courier Mail on 1 August 2019:

Home value on the rise again

One of the biggest challenges for the property market in 2018 was the Royal Commission into the banking industry. It had a significant impact, which rippled through to 2019, as financial markets tightened their lending policy. As a result, it became extremely difficult to obtain finance. This obviously had a flow on effect to the market as a whole given less buyers were able to achieve their desire of buying.

‘APRA’, the Australian Prudential Regulation Authority, monitors and regulates the financial industry. They introduced significant policy that restricted the banks’ ability to lend without meeting stringent criteria. The good news is, this policy has now been relaxed and there will certainly be a flow on effect to the general consumer as finance approvals are expected to increase. More Buyers means more demand which equals more Sales. It is the simple ‘Supply and Demand’ theory. Whilst I understand there are many factors that have an impact on finance and property markets this, and an oversupply of property, were the biggest factors for a volatile market during 2018 and through to the start of 2019.

It was certainly interesting times, particularly given that during all those ‘Doomsday Predictions’, Sinnamon Park achieved a record sale of $2.5m. A superb result for a stunning home in the Windermere Estate, and the records continued with a series of other results above $1.0m. An absolute testament to this family orientated area that is making its mark on the Brisbane property landscape.

This brings us to the specifics of the market performance for Sinnamon Park during the 2018/2019 financial year.

Sales Breakdown 2018/19 FY – Sinnamon Park

| TYPE | No. OF SALE | MEDIAN PRICE | LOWEST PRICE | HIGHEST PRICE |

| ALL | 93 | $695,000 | $345,000 | $2,500,000 |

| HOUSE | 78 | $730,000 | $460,000 | $2,500,000 |

| UNIT/TOWNHOUSE | 17 | $418,000 | $345,000 | $635,000 |

| LAND | 2 | $451,250 | $430,000 | $472,500 |

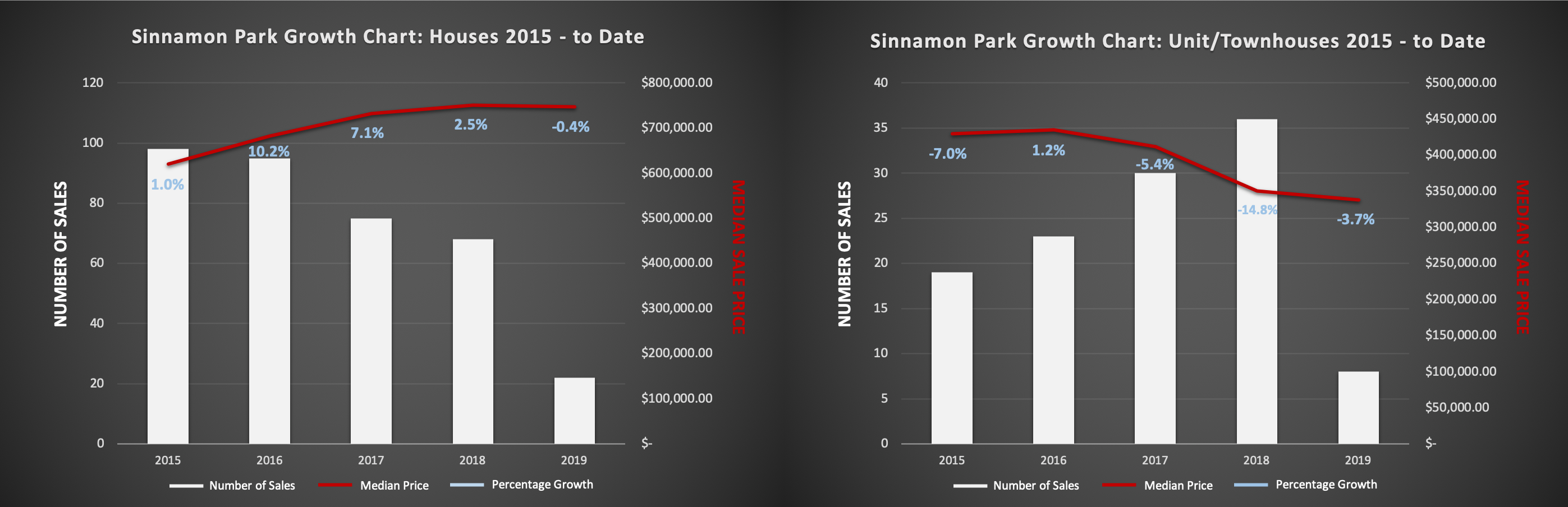

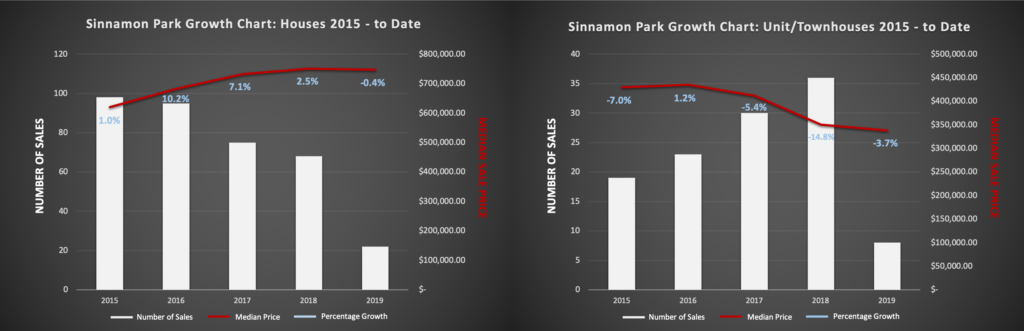

Median Growth ‘Houses’ – Sinnamon Park

| YEAR | NO. OF SALE | MEDIAN PRICE | % OF GROWTH |

| 2015 | 98 | $620,500 | 1.0% |

| 2016 | 95 | $683,500 | 10.2% |

| 2017 | 75 | $732,000 | 7.1% |

| 2018 | 68 | $750,444 | 2.5% |

| 2019 | 22 | $747,500 | -0.4% |

Median Growth ‘Units & Townhouses’ – Sinnamon Park

| YEAR | NO. OF SALE | MEDIAN PRICE | % OF GROWTH |

| 2015 | 19 | $430,000 | -7.0% |

| 2016 | 23 | $435,000 | 1.2% |

| 2017 | 30 | $411,506 | -5.4% |

| 2018 | 36 | $350,700 | -14.8% |

| 2019 | 8 | $337,750 | -3.7% |

SINNAMON PARK – House & Unit/Townhouse Growth

The above data is a complete contrast and the visual elements speak a ‘thousand words’. It demonstrates that the median price for the unit & townhouse market has been in decline, whilst the sales volume and supply has increased. Whereas the housing market has benefited from a steady increase in the median price, whilst the volume of transactions and associated supply has declined considerably. This growth is simply a byproduct of lower supply and in my view is unsustainable. addition, the trend line for the housing market is just starting to take a downward turn. The inevitable increase in supply is coming, and I predict this will commence later this year and flow into early 2020, as the mood turns more positive. An increase in supply leads to more choice for buyers and as a result it is likely to reflect in competitive pricing. I personally believe there is a unique window of opportunity in the next 1 to 3 months to get ahead of the market!

THE TOP 5 – Sinnamon Park 2018/19 FY

A list of the top 5 highest price sales in Sinnamon Park for the 2018/19 Financial Year.

| $2,500,000 5 Bed | 5 Bath | 4 Car 32 Burdekin Drive, SINNAMON PARK McGrath - Reuben Packer-Hill |

| $1,500,000 5 Bed | 3 Bath | 3 Car 103 Burdekin Drive, SINNAMON PARK LJ Hooker - Scott Gemmell |

| $1,447,000 4 Bed | 3 Bath | 2 Car 108 Burdekin Drive, SINNAMON PARK Position Property Services - Peter Robertson |

| $1,340,000 4 Bed | 3 Bath | 3 Car 2 Brinley Place, SINNAMON PARK LJ Hooker - Scott Gemmell |

| $1,275,000 5 Bed | 3 Bath | 2 Car 12 Barcoo Crescent, SINNAMON PARK LJ Hooker - Scott Gemmell |

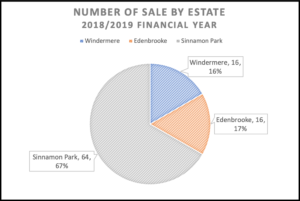

No. OF SALES BY ESTATE & SECTION – 2018/19 FY

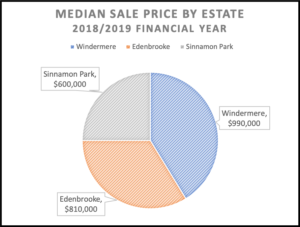

MEDIAN SALE PRICE BY ESTATE & SECTION – 2018/19 FY

Rental Yields

SINNAMON PARK

Quarterly Rental Yields – per week.

| TYPE | Q3 2018 | Q4 2018 | Q1 2019 | Q2 2019 |

| All Houses | $485 | $520 | $550 | $550 |

| 3 Bedroom | $400 | $430 | $430 | $387.50 |

| 4+ Bedroom | $565 | $602.50 | $600 | $560 |

| Apartments | $370 | $420 | $440 | $372.50 |

In conclusion…

If you are a Buyer and have been waiting for the market to bottom, I suggest you stop and take action NOW because waiting is likely to cost YOU! If you are a Seller and have been waiting for the right time, then the indicators are depicting there is a small window of opportunity over the next 2 to 3 months.

As we enter the traditional Spring selling season, sellers will gain confidence as positive stories start to fill the market. As a result, we will see an increase in supply as Sellers endeavour to take advantage of more buoyant times. Remember the theory of ‘Supply and Demand’? At present, there is a shortage of supply for quality homes, in our area, and across the Brisbane market generally. Waiting could also be costly, as the supply is sure to increase toward the end of 2019.

As you can see we clearly understand your local market. If you would like to discuss any element of this report or ascertain the value of your home simply click below to request a specific report relating to your specific property.

I look forward to seeing you around the area … and make sure you look out for our report in your Sinnamon Park letterbox which has great offers from some wonderful local businesses.